boise idaho sales tax rate 2019

However the total tax rate is dependent on your county and local taxes. The average local rate is 003.

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

While many other states allow counties and other localities to collect a local option sales tax Idaho does not.

. Depending on local municipalities the total tax rate can be as high as 9. Levy rates for 2019 in Boise were at their lowest levels in at least. Higher sales tax than 95 of Idaho localities 3 lower than the maximum sales tax in ID The 6 sales tax rate in Boise consists of 6 Idaho state sales tax.

There is no applicable county tax city tax or special tax. The minimum combined 2022 sales tax rate for Boise Idaho is. The sales tax jurisdiction name is Boise Auditorium District.

Last full review of page January 27 2016. The Boise Auditorium District Idaho sales tax is 600 the same as the Idaho state sales tax. The 6 sales tax rate in Garden City consists of 6 Idaho state sales tax.

This means that Idaho taxes higher earnings at a higher. The Idaho ID state sales tax rate is currently 6 ranking 16th-highest in the US. Does Idaho have sales tax on cars.

We used 2019-2021 to take out the impact of the Governors Public Safety Grant Initiative. This is the total of state county and city sales tax rates. Cities with local sales taxes Contact the following cities directly for.

The December 2020 total local sales tax rate was also 6000. Get Boise Property Tax Rate. Some but not all choose to limit the local sales tax to lodging alcohol by the drink and restaurant food.

The current state sales tax rate in Idaho ID is 6. Boise ID Sales Tax Rate ID Sales Tax Rate The current total local sales tax rate in Boise ID is 6000. 31 rows Idaho ID Sales Tax Rates by City Idaho ID Sales Tax Rates by City The state sales tax rate in Idaho is 6000.

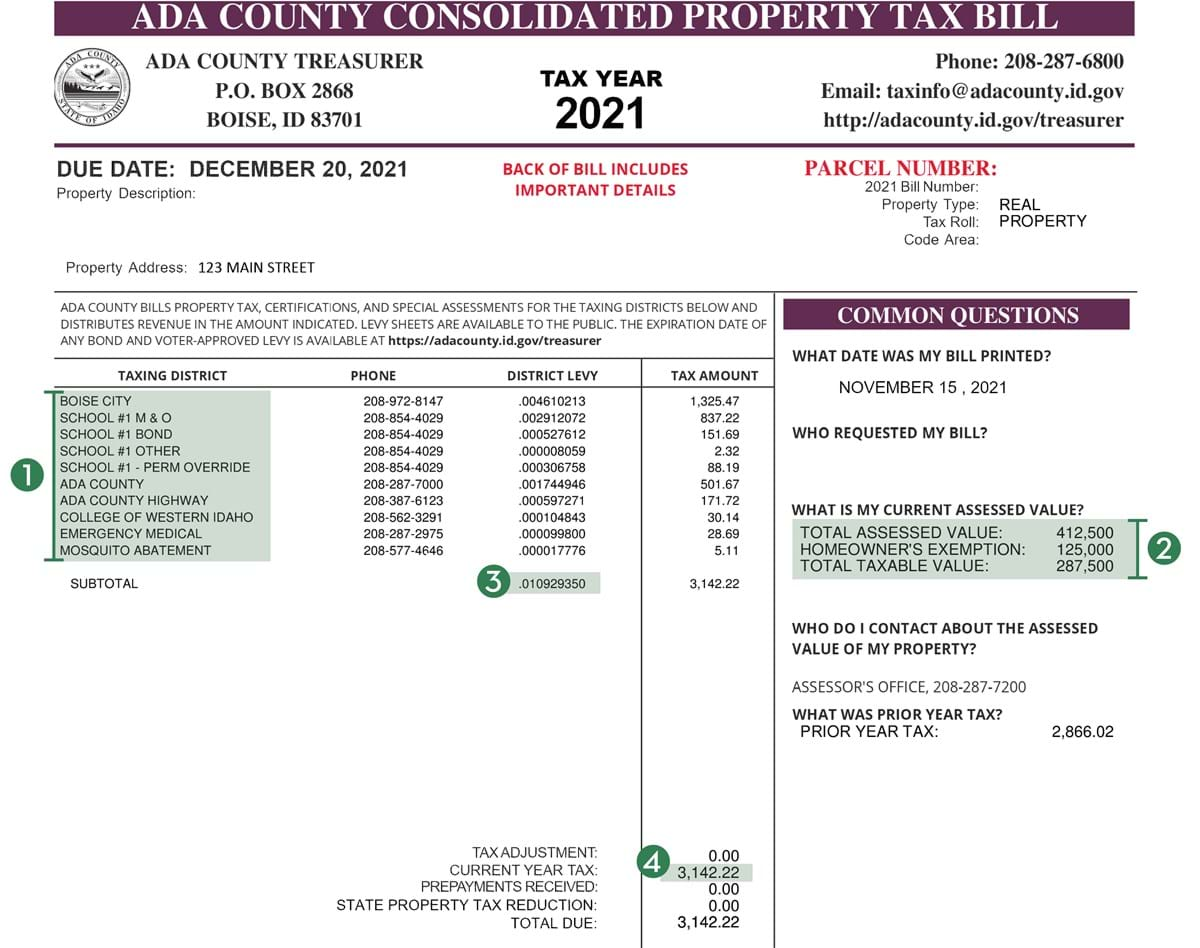

The Boise Idaho sales tax is 600 the same as the Idaho state sales tax. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Levy Rates Voter Approved Fund Tracker 2021.

Non-property taxes are permitted at the local. Boise is located within Ada County. Income tax rates range from 1 to 65 on Idaho taxable income.

The total tax rate might be as high as 9 depending on local municipalities. Voter Approved fund tracker 2020 INFORMATION AND DATES TO REMEMBER The next tax deed sale will be September 2023. What is the sales tax rate in Boise Idaho.

All car sales in Idaho are subject to a state sales tax rate of 6. With local taxes the total sales tax rate is between. Find houses and flats for sale and to rent estate agents real estate.

The Idaho sales tax rate is. Individual income tax is graduated. There is no applicable county tax.

A levy rate of 014 rounded to three decimals means you owe 14 of taxes for every 1000 of your propertys taxable value. While many other states allow counties and other localities to collect a local option sales tax.

Sweeping Property Sales Tax Proposal Dead For 2022 Session

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Rustic Acres 608 North Empress Street Mobile Home For Sale In Boise Id 1098574 Mobile Homes For Sale Mobile Home Rustic

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

One Time Tax Rebate Checks For Idaho Residents Klew

Total Sales Tax Per Dollar By City Oklahoma Watch

What The 2019 Housing Market Might Bring Us Real Estate Tips Housing Market Real Estate Marketing

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho Sales Tax Guide And Calculator 2022 Taxjar